salt tax cap repeal

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. However altering the cap might make it easier for states and localities to.

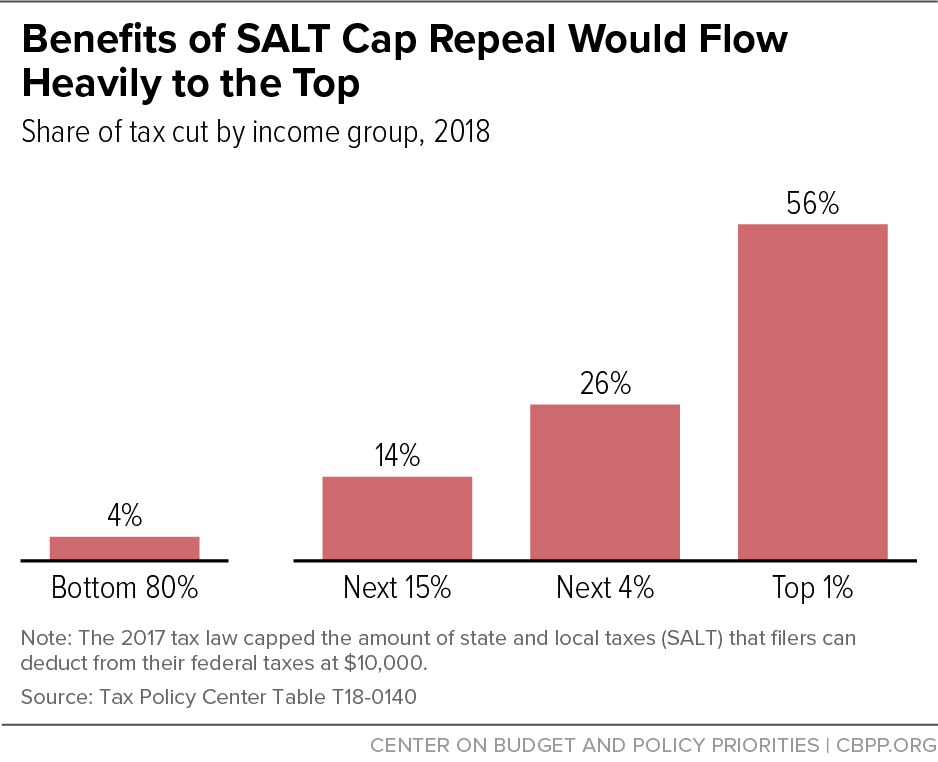

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Over 50 percent of this reduction would accrue to taxpayers in just four.

. Joe Manchin D-WVa blew it up last month say theres simply not enough. Most taxpayers opt for the standard deduction when filing their taxes. Yellen blessing the SALT cap in October appeared to foreclose a judicial repeal of the SALT Cap over constitutional claims although four states have recently requested US.

Americans with six-figure salaries and high property and state income tax bills will see the most noticeable effects from lifting the 10000 SALT cap according to an analysis by accounting firm. Senate Democrats who were involved in negotiations over the bill before Sen. Supreme Court review of the decision.

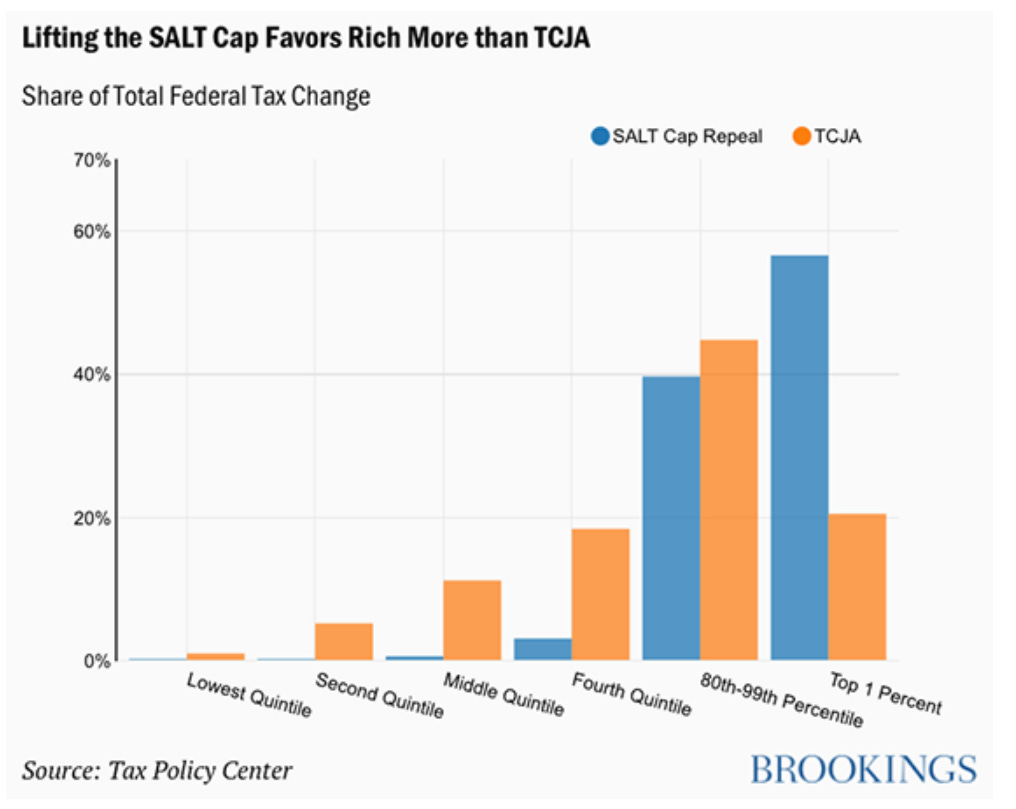

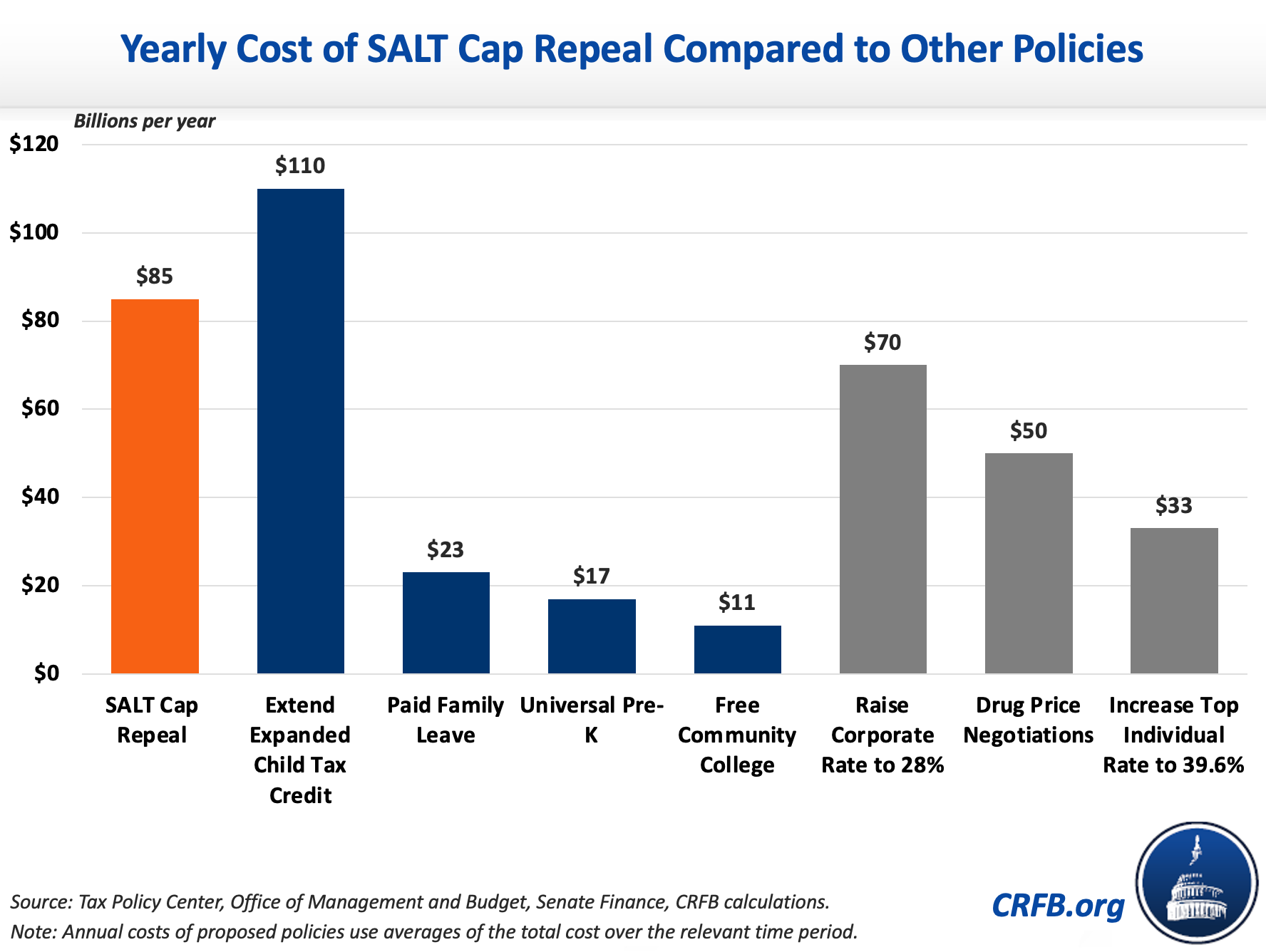

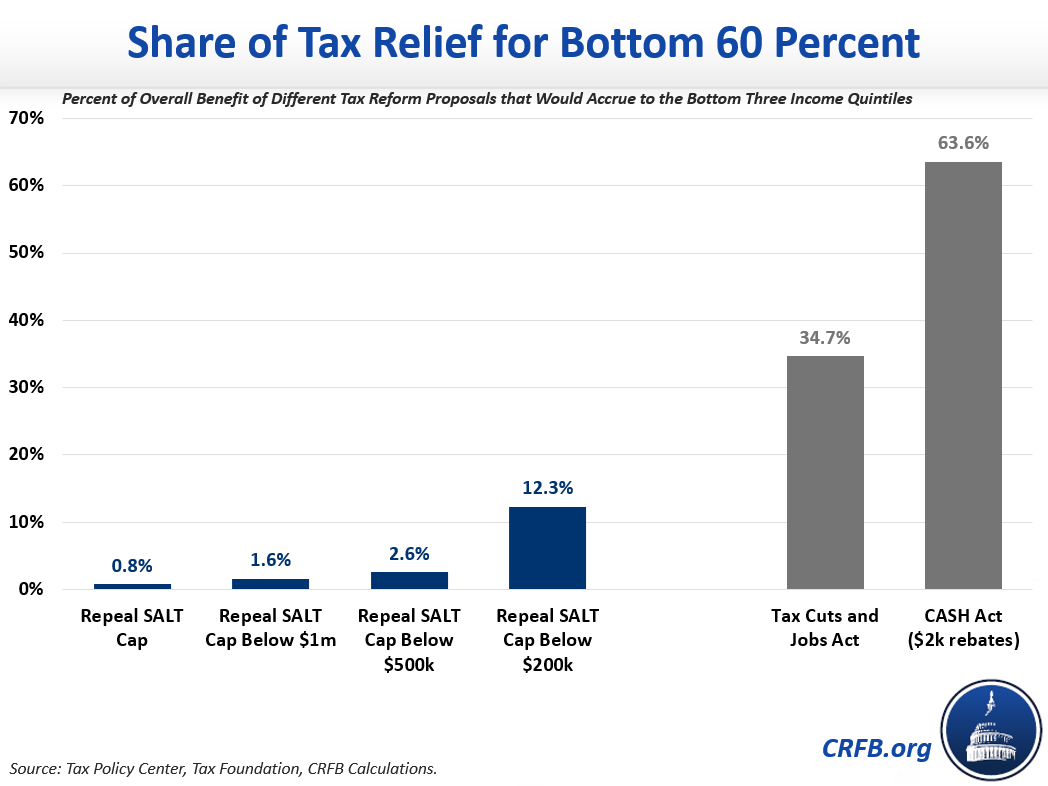

SALT Cap Repeal Below 500k Still Costly and Regressive. The house on thursday passed a bill to temporarily repeal the gop tax laws cap on the state and local tax salt deduction advancing a key priority for many democrats before leaving washington. SALT cap repeal is an example of a policy simultaneously geared toward families with higher incomes and more wealth.

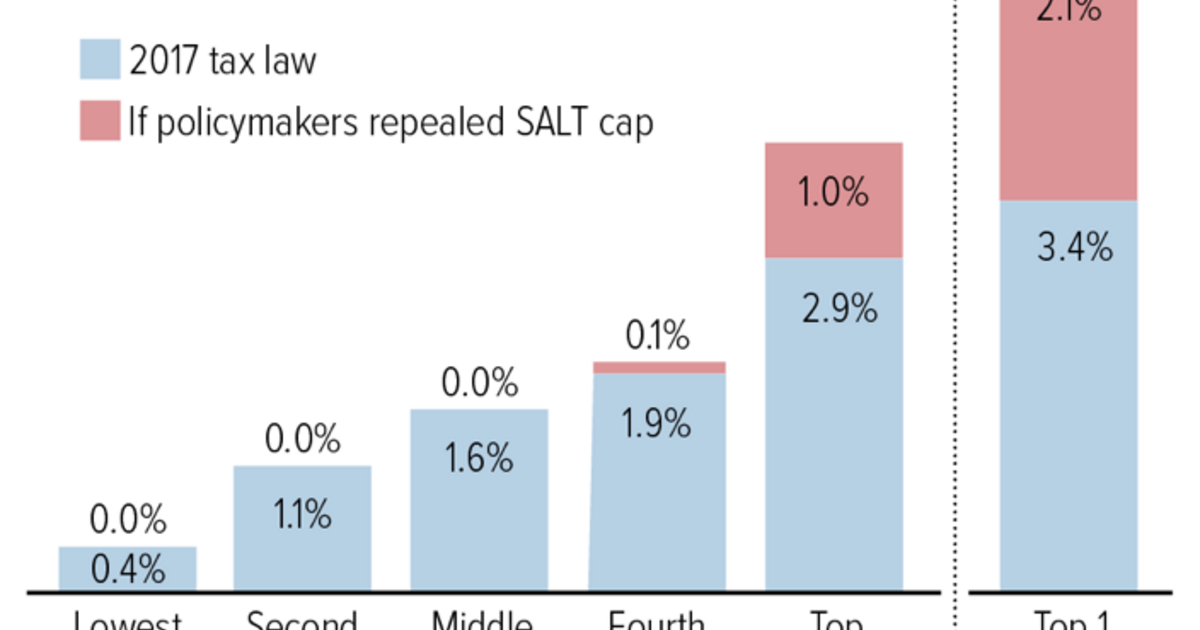

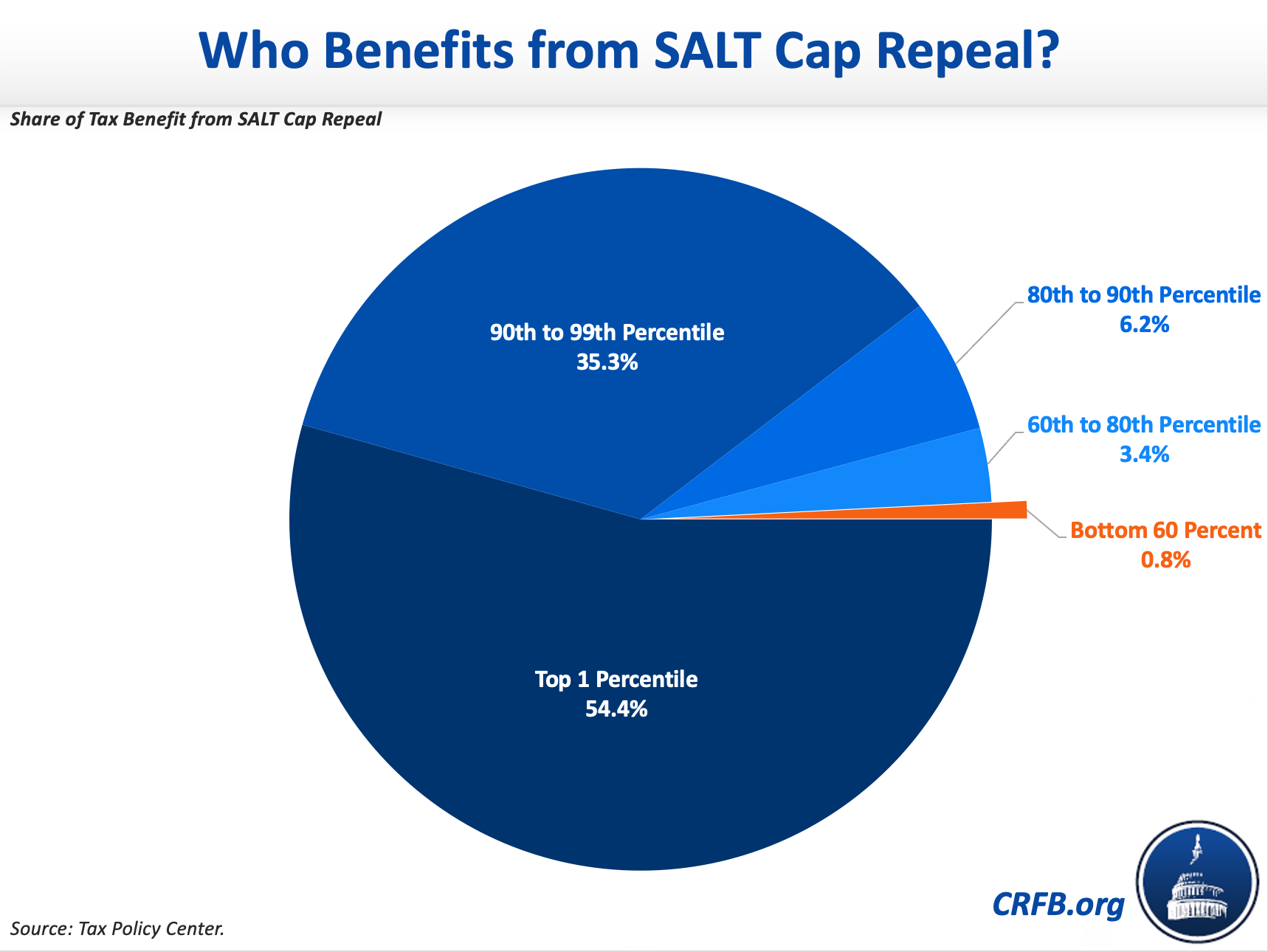

Under a full repeal the top 1 percent of households would receive an average tax cut of at least 35000 compared to a paltry 37 for their middle class counterparts. The benefits of the repeal of this cap would largely flow to their states. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

54 rows Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017. This phenomenon is a function of our tax code structure. Prior to the Republican tax reform of.

Most economists believe that a repeal of the cap on the SALT deduction would be regressive and costly to the federal government. However the bill stalled in December. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

The Build Back Better Act passed out of the House of Representatives includes a compromise provision that does not repeal the SALT cap but increases it significantly from 10000 to 80000. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for. That should spell the end for the SALT deduction a benefit for high earners in high-tax states.

The second proposal suggested by Golden in the Washington Post would fully repeal the 10000 SALT deduction cap but only for those making less than 175000 per year. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. The House passed two coronavirus relief bills last year that included a temporary repeal of the SALT deduction cap but those werent taken up by the Senate.

A Democratic proposal aims. The cap on the SALT deduction was created by Republicans 2017 tax cut law as a way to help pay for other tax provisions in that measure. Over 50 percent of this reduction would accrue to taxpayers in just four.

The cap would then be phased back down to 10000 for those earning between 400000 and 500000 per year in Adjusted Gross Income AGI. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut from the revised Build Back Better Act. The SALT Caucus made up exclusively of Members from California New York New Jersey Illinois Connecticut and the District of Columbia are pushing to repeal the 10000 SALT deduction cap.

Many Democrats from high-tax states have. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. Enacted by the Tax.

5377 which would suspend the 10000 cap placed on state and local tax salt deductions for 2020 and 2021 in addition to. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are advocating for a repeal or reform of that cap. ITEP previously estimated that three-fourths of the benefits of this provision would go to the richest 5 percent in 2022 and well more than a third of the benefits would go to.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The income tax portion of the SALT deduction is tied closely to families incomes while the property tax portion is tied to homeownership and home value which are major components of overall wealth. 1 day agoThe state and local tax deduction known as SALT was capped at 10000 under President Donald Trumps tax reform bill in 2017 in a move that Democrats decried as an attack on blue states like.

It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed.

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Dems Don T Repeal The Salt Cap Do This Instead Itep

The Heroic Congressional Fight To Save The Rich

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget