michigan sales tax exemption number

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Streamlined Sales and Use Tax Project.

Sales Taxes In The United States Wikipedia

How do I get a farm sales tax exempt in Michigan.

. 2022 Sales Use and Withholding Taxes MonthlyQuarterly Return. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. If your business sells products on the internet such as eBay or through a.

Sales Tax Return for. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the. The state sales tax rate is 6.

General Information on State Sales Tax. If you have quetions about the online permit application process. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account.

In order to claim exemption the nonprofit organization must provide the seller with both. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. Step 4 Indicate the reason for sales tax exemption.

Virtually every type of business must obtain a State Sales Tax Number. This page discusses various sales tax exemptions in Michigan. You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website.

Use tax is a companion tax to sales tax. Minnesota Sales Tax Fact Sheet 142. Sales tax of 6 on their retail.

For other Michigan sales tax exemption certificates go here. How to use sales tax exemption certificates in Michigan. Refer to this guide for common reasons that a business would be exempt from.

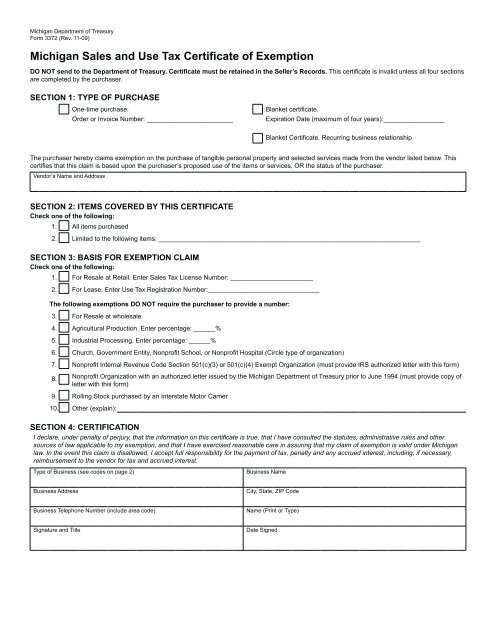

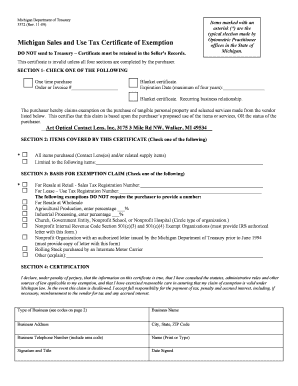

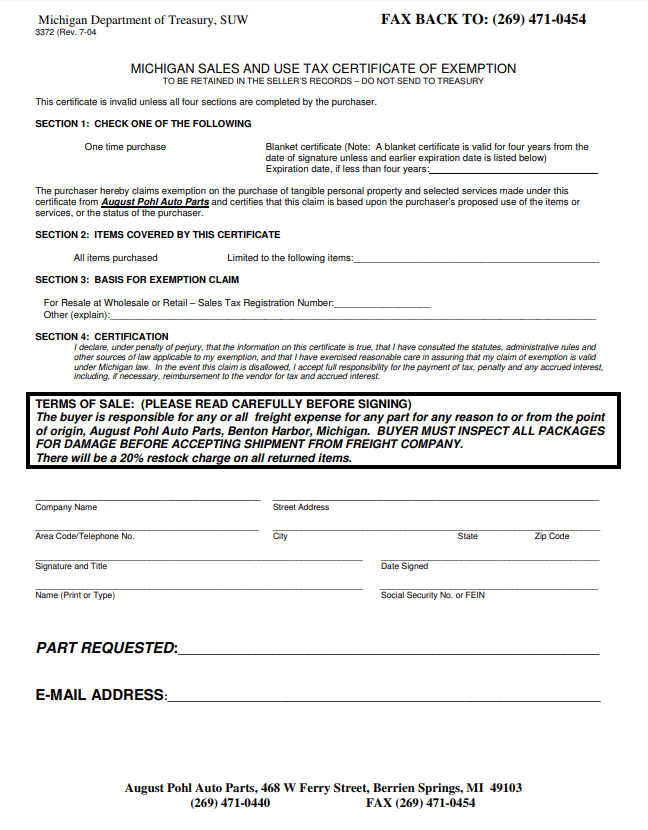

Enter Sales Tax License Number. A Resale Certificate is obtained by filling out Form 3372 from the Department of Treasury titled Michigan Sales and Use Tax Certificate of Exemption. If a retailer is purchasing merchandise for resale check box number 2 and include their Sales Tax License Number.

A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Notice of New Sales Tax Requirements for Out-of-State Sellers.

Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number. Michigan Revenue Administrative Bulletin 2013-4.

What is your tax exempt. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Form Number Form Name.

Types of Sales Tax Exemption Cards. This means that the business or entity making the purchase is exempt from paying sales tax. Foreign Diplomat Number The purchaser must.

Retailers - Retailers make sales to the final consumer. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use. Michigan State University Extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax on.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Michigan Sales and Use Tax Certificate of Exemption.

Once you have that you are eligible to issue a resale certificate. Ranked 21st highest by per capita revenue from the statewide sales tax 852 per capita Michigan has a statewide sales tax rate of 6 which has been in place since 1933.

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Expands Sales And Use Tax Exemption For Prosthetic Devices Rehmann

Printable Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

First Period Products Is Pet Food Next Here S What Else Michigan Lawmakers Want Exempt From Sales Taxes Mlive Com

Michigan Sales Tax Exemptions Agile Consulting Group

Mi Sales Tax Form August Pohl Auto Parts

Michigan Sales And Use Tax Certificate Of Exemption

How To Use A Michigan Resale Certificate Taxjar

How To Register For A Sales Tax Permit In Michigan Taxvalet

Michigan Sales And Use Tax Exemption For Ppe Uhy

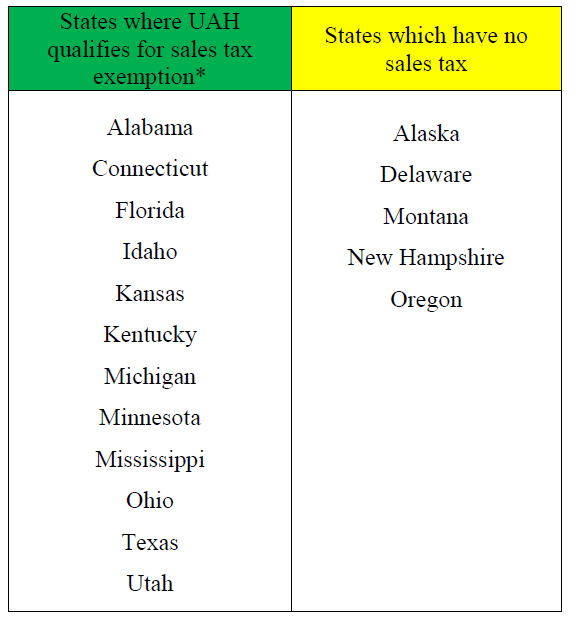

Uah Business Services News Tax Exemption Guidelines

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com